DoctorX is an innovative, meme-powered crypto project developed on the MultiverseX blockchain, backed by the ICE Open Network. Designed to gamify the process of mining and earning DRX tokens, DoctorX combines elements of entertainment with decentralized finance (DeFi), making it a unique proposition in the crypto ecosystem.

Who is DoctorX?

DoctorX is the main character of the project, serving as both a mascot and a central figure that embodies the fun, meme-driven ethos of the project. Drawing inspiration from meme culture, DoctorX brings a lighthearted yet engaging approach to crypto mining. Unlike traditional, more serious blockchain projects, DoctorX is playful, encouraging users to participate in a more casual and rewarding mining environment.

DoctorX operates within the ICE Open Network ecosystem, which provides decentralized identity services and other blockchain innovations. The project’s core focus is on allowing users to mine DRX tokens in a fun, team-based environment that emphasizes cooperation, flexibility, and continuous engagement.

How to Play?

Participation in DoctorX revolves around mining DRX tokens. Users download the DoctorX app, which allows them to mine tokens daily. However, the mining mechanism isn’t monotonous—DoctorX introduces features like “days off” and team-based mining to keep users engaged:

- Days Off: Users can mine for six consecutive days and take the seventh day off without losing their mining streak or rewards. This flexibility allows participants to avoid penalties for missing a day, making mining more user-friendly.

- Teams: The project encourages collaboration by allowing users to form teams with friends. By inviting others, users not only boost their own mining efficiency but also increase their rewards. Teams create a sense of community and collective effort, enhancing the overall experience.

- Resurrection Option: For those who miss an extended period (up to 7 days), the Resurrection feature allows them to recover lost rewards if activated within 30 days. This safety net adds a layer of flexibility to ensure users don’t feel punished for temporary inactivity.

How Does it Work?

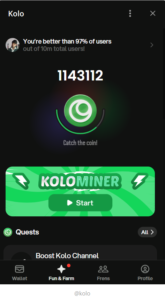

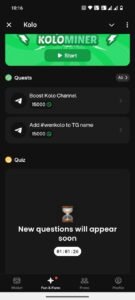

DoctorX utilizes a tap-to-earn system where users interact with the app daily to extend their mining sessions. The mining process rewards users with DRX tokens, which can accumulate over time. To maintain consistency and fairness in the system, the project employs a “slashing” mechanism. If users become inactive or fail to extend their sessions, their rewards can be temporarily reduced, motivating them to stay engaged.

Moreover, DoctorX has various levels of boosts that can be activated to enhance mining rewards. For example, Level 3 boosts increase mining rates and also help avoid penalties such as slashing. With these upgrades, users can significantly improve their DRX token earnings.

How to Earn DRX Tokens?

Earning DRX tokens in DoctorX revolves around consistent mining activities and referrals. Here’s how users can maximize their earnings:

- Daily Mining: Users must extend their mining sessions each day to continue earning DRX tokens. Mining is automatic once activated, and as long as the user maintains an active streak, tokens accumulate. Miss a day? No worries—use the day-off feature to maintain your streak.

- Boosts: Users can unlock various levels of boosts to enhance their mining output. The Level 3 boost, for example, increases the mining rate by 50% and also protects the user from slashing penalties, ensuring more consistent rewards.

- Referrals: Inviting friends to join the platform is a major source of additional earnings. Users earn 2,000 DRX tokens for every friend they refer, with no upper limit on the number of referrals. Moreover, active referrals mining alongside you can increase your bonus by an additional 25%, further boosting your token stash.

- Team Mining: Collaborating with friends or other users in a team amplifies the mining experience. Teams that mine together are rewarded with higher collective earnings, adding a cooperative dynamic to the process.

- Avoiding Slashing: To keep earnings at their maximum, users should aim to avoid inactivity. Slashing occurs when users fail to extend their mining sessions or exhaust their days off. However, by staying active or upgrading to Level 3, users can prevent or recover slashed tokens, ensuring continuous growth of their DRX balance.

DoxtorX Community Growing Faster

DoctorX has rapidly gained popularity, becoming one of the fastest-growing communities within the ICE Open Network ecosystem. Its success is driven by its unique blend of meme culture, ease of access, and collaborative mining features, which resonate well with users looking for both entertainment and rewards. The project’s team-based mining system and referral bonuses have helped foster a strong sense of community, encouraging growth through active participation and social engagement.

One of the key reasons for the community’s fast growth is the engaging nature of DoctorX’s gameplay, combined with the opportunity to earn DRX tokens. By tapping into meme culture and offering flexible, user-friendly mining, DoctorX appeals to a wide audience—especially younger, tech-savvy users familiar with crypto and online communities.

Social media and Telegram groups dedicated to DoctorX have seen a surge in activity, as users share tips on maximizing DRX earnings and collaborate in teams. This growth has been further bolstered by the ICE Open Network’s credibility, attracting users who are already part of its ecosystem, and providing a solid foundation for DoctorX to thrive.

Incorporating feedback from the community and creating an inclusive, participatory environment has helped DoctorX become more than just a crypto mining project—it’s evolving into a vibrant online movement. As more users join, the community sentiment remains overwhelmingly positive, fueled by the project’s ability to provide real rewards in a fun, engaging manner.

Why Choose DoctorX?

DoctorX stands out due to its fusion of memes, community involvement, and crypto mining. Here’s why it’s an attractive option:

- Meme Culture Appeal: The project embraces meme culture, which has been a major trend in the cryptocurrency world. This lighthearted approach makes it more accessible and appealing to a broader audience, especially those who enjoy fun and entertainment in addition to earning rewards.

- Community and Team Features: DoctorX’s emphasis on team-building adds a unique social component to mining. By collaborating with friends, users not only have a more enjoyable experience but also increase their chances of higher rewards. The referral system further encourages users to grow their networks, thus enhancing both individual and collective earning potential.

- User-Friendly Mining: Unlike traditional mining, which often requires technical know-how and expensive equipment, DoctorX simplifies the process. The app-based mining system is designed for casual users who want to earn DRX tokens with minimal effort.

- Flexibility: With features like days off and the Resurrection option, DoctorX offers a level of flexibility that is uncommon in the crypto space. This ensures users don’t feel pressured or punished for taking breaks from mining.

In conclusion, DoctorX combines the best elements of meme culture, community, and DeFi to offer a unique crypto mining experience. With its flexible mining system, engaging team dynamics, and playful approach, it provides both entertainment and financial rewards, making it an appealing project for casual and serious crypto enthusiasts alike.

Binance BTC inflows by investor cohort. Source: Crypto Quant

Binance BTC inflows by investor cohort. Source: Crypto Quant

Google Trends RSI data for “Bitcoin.” Source: CryptoCon/X

Google Trends RSI data for “Bitcoin.” Source: CryptoCon/X